What if your career could influence monetary policy, regulate markets, or strengthen rural development all while offering long-term growth and respect? Careers such as RBI Grade B, SEBI Grade A, & NABARD Grade A do exactly that, yet remain underexplored by students. Read on to understand these roles, & why early awareness matters.

Most students grow up hearing about careers in engineering, management, or in the civil services. However, very few are exposed to the wide range of career opportunities within India’s financial governance system. Institutions such as the Reserve Bank of India (RBI), National Bank for Agriculture and Rural Development (NABARD), and the Securities and Exchange Board of India (SEBI) play a critical role in shaping how the country’s economy functions often behind the scenes.

Careers in financial governance directly influence monetary policy, rural credit systems, financial markets, and overall economic stability. Yet, these impactful roles rarely feature in mainstream career conversations among students.

The issue is not a lack of interest, but a lack of exposure. Schools and colleges do not often expose their students to how regulatory institutions operate and the importance of financial governance. As a result, financial governance remains an unfamiliar domain rather than a visible and aspirational career path.

Building awareness around these careers is essential. It helps students understand that financial governance is not merely an exam-oriented path, but a meaningful public service profession – one that allows individuals to contribute directly to national development and public well-being.

Why Awareness About Financial Governance Matters Today?

India’s financial ecosystem is undergoing rapid transformation. From digital payments and fintech innovation to rural lending, investor protection, and financial stability, these systems are regulated and guided by strong institutions such as RBI, SEBI, and NABARD. These organisations form the backbone of India’s economic framework.

Despite this, a large proportion of college graduates remain unaware of structured public-sector careers within these institutions. Many students complete their education without ever learning about roles that combine financial expertise, policy-making, and public service.

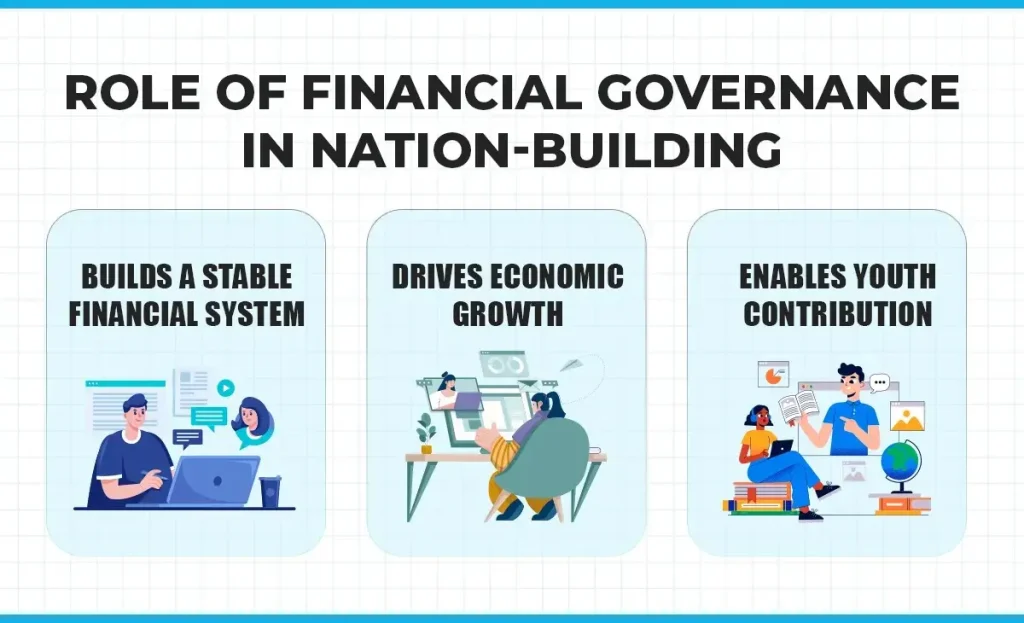

The work carried out by RBI, SEBI, and NABARD has a direct impact on citizens’ daily lives – from banking access to market safety and agricultural credit. Careers in these institutions allow young professionals to actively participate in nation-building while developing long-term, stable, and purpose-driven careers. When students understand this connection, financial governance begins to emerge as a credible and aspirational career option rather than a hidden niche.

How Students Benefit from Early Exposure to Financial Governance Careers?

Early exposure to financial governance helps students develop a foundational understanding of how money flows through the economy, how markets are regulated, and how public financial systems operate. A common misconception among students is that careers in finance are limited to private-sector roles or require advanced financial expertise from the very beginning. In reality, regulatory institutions value analytical thinking, awareness of economic issues, and an interest in public policy as much as formal finance training. While these roles do require financial knowledge, professionals are trained extensively after selection, making them accessible to students from diverse academic backgrounds.

This information is often missing, particularly for students from non-commerce streams or smaller towns. Bridging this information gap can significantly expand career possibilities for a large section of India’s youth.

Bridging the Gap: Why Institutions and Educators Must Step In

Career literacy is an essential part of holistic education, yet financial careers – especially in public institutions receive very little attention in schools and colleges. Educators, institutions, CSR, NGOs and career counsellors have a powerful role to play in changing this narrative.

By introducing students to organisations such as RBI, SEBI, and NABARD, educational institutions can encourage learners to think beyond conventional career paths. These roles not only offer professional growth and stability but also provide opportunities to contribute meaningfully to society.

A lot of educational institutions have started inviting guest speakers or experts in a certain field to guide students. Extending this approach to include professionals and veterans from financial regulatory bodies can greatly enhance students’ understanding of financial governance and public policy careers. Such initiatives spark curiosity, broaden career awareness, and help students make informed choices early in their academic journey. Over time, consistent exposure can ensure that financial governance is viewed as a viable and respected career pathway.

How Financial Governance Careers Support National Development?

Financial governance is a critical pillar of a stable and inclusive economy. Institutions such as RBI, NABARD, and SEBI ensure that financial systems operate fairly, transparently, and sustainably. When students join these organisations, they become part of the institutional framework that supports economic growth, financial inclusion, and investor confidence. This sense of purpose and responsibility makes these careers especially meaningful. Understanding the nation-building aspect of these roles can strongly motivate students to pursue them with dedication and long-term commitment.

What Students Need to Know About These Careers

If we talk about careers in RBI, NABARD, or SEBI, here’s what these institutions offer as an entry level career for which these organisations take an exam:

RBI Grade B:

- This is a Manager post for which the RBI Grade B exam is conducted every year.

- This RBI Grade B role involves working on policies that maintain banking stability, manage inflation, regulate payment systems, and supervise financial institutions. An RBI Grade B manager also works on keeping inflation in check, supervises the finance system, manages the currency system, and looks after payment systems.

- Decisions taken at this level influence both macroeconomic outcomes and everyday banking operations.

SEBI Grade A

- SEBI Grade A is an Assistant Manager post. SEBI conducts an exam for this post.

- SEBI Grade A officers work in areas such as investor protection, corporate disclosures, market regulation, and oversight of financial intermediaries.

- This role is well-suited for students interested in capital markets, securities, and regulatory frameworks.

NABARD Grade A

- This exam is for the post of Assistant Manager, for which NABARD conducts an exam every year.

- NABARD officers collaborate with state governments, banks, and cooperatives to enhance rural credit, support farmers, and strengthen rural infrastructure.

- This NABARD Grade A role is ideal for students motivated by financial inclusion and grassroots development.

Together, these career paths demonstrate that financial governance is accessible to students from diverse academic backgrounds – not only to finance specialists. With awareness through financial literacy learning material, consistent effort, and a genuine interest in public service, students can build impactful careers in this vital sector.